NewtonCityHall1

Newton City Hall, June 2023. Photo by Bryan McGonigle

Mayor Fuller met with the City Council Committee of the Whole recently to get budget talks started and highlight some of the city’s financial goals for the upcoming Fiscal Year 2025 budget season.

And she let everyone know that she thinks a Proposition 2 ½ tax levy override will be needed on the horizon to pay for the city’s schools, just weeks after negotiating a new contract for school employees.

“We’re in a good place, we settled a contract that we can afford,” Fuller said. “I would say, though, that I think it is a permanent feature that the needs of our kids are increasing and will stay high, even as enrollment dips.”

Proposition 2 ½ is a state law that limits how much a city or town can raise taxes. The total tax levy on a community is not allowed to be more than 2.5 percent higher than the previous year, not counting new growth.

Fuller and the Newton School Committee negotiated a new contract with the Newton Teachers Association to end the teachers’ strike in February that added a fourth year as well as more money for teacher pay and additional support staff.

“We definitely need to look at the next ten years for the Newton Public Schools and map it out,” Fuller said. “And it will be very important to have an operating override to support the Newton Public Schools, and if it does not pass, it will have consequences.”

Fuller asked for three overrides in 2023. One was for $2.3 million a year for 30 years to be spent to renovate the Countryside School. The second was for $3.5 million a year for 30 years to renovate the Franklin School. The third was a request to add $9.2 million to the general budget, which would remain in the budget permanently.

Voters rejected that third one, setting off a budget crisis in the middle of a school contract dispute and eventually a teachers’ strike that’s still impacting the schools and the community.

Pre-season preview

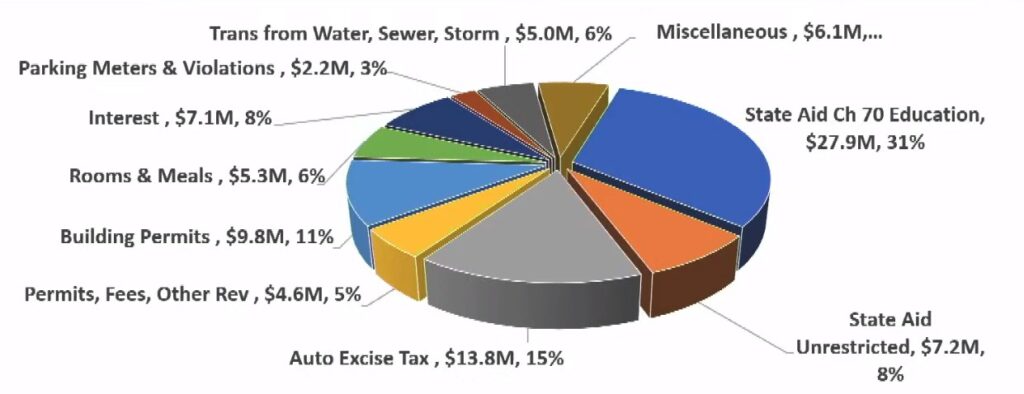

The FY2025 budget is expected to have $526 million in revenues, Fuller said, with 83 percent of that coming from property taxes. About 90 percent of that property tax revenue is in residential property taxes, while 10 percent is from commercial property taxes.

That means the budget will have $526 million in total expenses, and Fuller said she wants the schools to get 54 percent—$282.4 million—of that.

“Out of the three largest municipal departments, each are about 10 percent of that size,” Fuller said. “Police is $24 million, Fire is $25 million, $DPW is $26 million.”

And that doesn’t include school nurses’ pay and crossing guards’ pay, which comes out of the municipal operating budget. So the schools actually end up with more than 54 percent of the city’s money.

The meeting was a listening session for the mayor and the Council. Fuller will present her formal budget recommendation in April. For now, she let the Council know her office would prioritize thoughtful and effective spending.

“There isn’t one dollar that’s spent that we don’t worry about it,” Fuller said.

Fuller’s priority list included the usual: balancing short-term spending with long-term needs; making sure recurring expenses are matched with recurring revenues; paying employees well; and keeping the city financially strong.

On a bright note, Fuller announced at that meeting that the city had again received a AAA bond rating from Moody’s. The AAA rating makes it less expensive for the city to borrow money for capital improvement projects.